Ethics in Digital Age

Keynote remarks, Paul H. Dembinski – 31st Asia Pacific Conference on International Accounting Issues

SGH – Warsaw, 14 of October 2019

It is a great honor, but also a pleasure to be given this opportunity to share with this distinguished audience of the 31st Asian-Pacific Conference on International Accounting Issues some thoughts and concerns about the role of ethic in the unfolding digital age.

Special thanks for this invitation to SGH-Warsaw School of Economics, and more personally to prof. Anna Karamanska, the magic hand behind most of what we are going to experience during these two days.

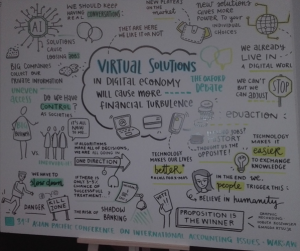

Digital age is the age of changing relations between two layers of reality: the virtual reality made of information flows, databases and networks, and the hard reality – for lack of a better word. The first one is entirely man-made, while the second, has been there forever, and is only transformed by human efforts and activities.

Until recently – before the dawn of the digital age – the word “virtuality” was used to describe the picture, the model or the representation of the hard reality. Virtuality was only a derivative, derived from the hard reality, and thus passively dependent on this reality. Digital age has brought change into this relationship. Virtuality not only became to a large extent autonomous, but also started shaping reality. This is, in my understanding, what makes the digital age so fascinating. In the last analysis, virtuality still depends on hard reality, on electric power supply, on the proper functioning of the hardware and on the performance and limits of the synchronizing devices that command the proper working of the net. In recent years we have real life experiences of breakdowns of local “systems” such as airports. When virtual reality break down, hard reality suffers and often turns into chaos.

Until recently – before the dawn of the digital age – the word “virtuality” was used to describe the picture, the model or the representation of the hard reality. Virtuality was only a derivative, derived from the hard reality, and thus passively dependent on this reality. Digital age has brought change into this relationship. Virtuality not only became to a large extent autonomous, but also started shaping reality. This is, in my understanding, what makes the digital age so fascinating. In the last analysis, virtuality still depends on hard reality, on electric power supply, on the proper functioning of the hardware and on the performance and limits of the synchronizing devices that command the proper working of the net. In recent years we have real life experiences of breakdowns of local “systems” such as airports. When virtual reality break down, hard reality suffers and often turns into chaos.

The digital age is also the age of global organizations which are built as interfaces between the hard reality of goods and services and the virtuality of payment and information flows. Indeed, the two components – sides – of reality never totally match, they are never fully in tune. In consequence tensions and conflicts are common and normal because: virtuality is about numbers and homogenous categories while reality is about the uniqueness of persons, places and situations. For this reason, virtuality is where “rational” views set on numbers and homogenous categories prevail while hard reality is where emotions and ethical concerns have their roots.

As virtuality is expanding faster and faster, and as it is shaping reality every day more, the question about ethics in ever more pressing. I will mention three main resons for concern, and in the conclusion, some possible avenues for action.

The growing asymmetry of economic power

Digital age, big data breed big and powerful (global) organizations which know more and more about every single one of the clients and customers. In consequence, these powerful players are able to supply each of us with a “personalized” or “customized” or “dynamic” prices – outcomes of complex pricing algorithms geared at maximizing vendors’ proceeds. Paradoxically, every time the client generates new information by manipulating his screen or his mobile, he becomes more vulnerable to this kind of (predatory) targeting. Digital age technologies are feeding the asymmetry in price making power which is a direct threat to a properly working market mechanism and to its promises of efficiency and optimality. More broadly, as demonstrated by Cambridge Analytica, information breeds power, which breeds temptations of misuse.

Without properly acknowledging, it our societies are at risk of drifting into “Big brother’s” territory. Even when Big brother does not materialize in a kind social control scheme, the virtual gigantism can easily be used to exert pressure on the weak party of the relation. Personal ethics, in the sense of self-restraint will probably not suffice, as such extrusion possibilities may attract unscrupulous players. To contain the danger, what is needed are interventions and guidelines at the social ethics level, i.e. regulatory ones. Indeed, the very institution of the market is at risk, with its moral justification of freedom of choice.

The “moral distance”

The second reason of ethical concern is the growing “moral distance”. This notion is not new in ethical discourse, it refers to the pressure an ethics question might exert in a given situation. We have all experienced a sense of ethical urgency, when faced with the proximity of an unusual event, happy or dramatic. The feeling of urgency is much more pressing when the event happens in immediate proximity than when we read or watch reports about it. Ethical concern is also stronger in case of proximity. Moral distance is exactly about this. When seated comfortably in a nice office connected to the virtual world, chances are small to feel a strong ethical concern when pressing a key on the keyboard. Real life consequences of our deeds are far away, mediated by number of real or virtual screens. This is the everyday experience of Human Resource departments firing and hiring people remotely, on the other side of the world.

The issue of “moral distance” is not new, it has been clearly identified in Middle Ages, and possibly before. The Lateran Council (XII century) issued a statement forbidding the use of a technology that was new for that time: the crossbow. The argument was that the arrow could reach targets outside of sight for the archer who, in consequence, could not properly appreciate – morally judge – the effects of his deeds. The moral distance was, in this case a sufficient reason to ban the tool.

In modern time, digital technologies are – at least in some aspects – the crossbows of the digital age, and have distant consequences of many financial decisions. A long chain of intermediating screens or steps hide away from our eyes the whole picture of consequences of our deeds. As a matter of fact, our ethical sense is not waken up and, more often than not, we stick to technicalities and prefer ignoring the existence of an ethical problem.

The technological veil created a “moral distance” that has sheltered the financial intermediaries present in the “subprime” market from early reality check. We know the rest as we do the consequences of the delay in acknowledging the ethical issue. More generally, moral distance in times of digital age contributes to lowering of the general ethical awareness in financial and accounting professions. Ethical dilemmas seldom appear as such, in most cases the problem seems, prima facie, to be technical. The ethical roots become visible only after some effort has been devoted to disentangle ethics from technics.

Risk of “moral regression”

In 1960s, prof. Lawrence Kohlberg has developed a theory of stages of moral development. During the last sixty years, Kohlberg’s typology has been substantiated by hundreds of pieces of empirical research, including also business people and the accounting profession.

The keystone of Kohlberg’s typology is the notion of “convention” – the normal, the prevalent way of doing things, here in conducting business. Kohlberg distinguishes three stages of moral development, which I prefer to call three modes of moral reasoning.

- First stage is called “pre-conventional”. At this stage, the agent – person – is concerned exclusively with his/her physical comfort. In consequence, what is good and what is bad depend on the positioning of the stick and of the carrot. This is the kind of behavior that characterizes the well known homo oeconomicus;

- The second stage is called “conventional” as it refers to the opinion and behavior or other. The group – the herd – is the yardstick for proper and improper behavior. The conventional, is by definition part of the herd – kind of homo congregabilis.

- Only with the third stage, called “post conventional”, the agent is able to forge her/his own judgment referring to values and moral norms. The post conventional agent is a kind of homo ethicus.

Kohlberg has designed his theory for explaining the moral development of youngsters, I propose to use it to analyze the mindsets of economic and financial operators in the digital age.

Indeed my fear is that the asymmetry of analytical power together with the buildup of moral distance referred to above, may – if these two trends go unopposed – pave the way to what I propose to call “ethical regression” in business, finance and accounting. Ethical regression might well prove to be the unwanted heritage of the digital age.

Ethical regression could be defined as the progressive elimination of post-conventional (ethical) reasoning form the business world. This would, as consequence, leave all the space to less articulated pre-conventional or conventional modes of reasoning.

As organizations grow bigger and more complex, as more and more people are required to follow procedures, the room left for post-conventional thinking shrinks naturally. Under growing uncertainty and pressure to perform, rank employees and management are encouraged to deliver, not to think out of the box. A recent conversation with a group of middle-managers in Swiss companies has clearly showed that organizations are run by sticks and carrots and by acquired herd reflexes. This is what the top expects and welcomes, not more.

The studies about the effects of digitalization on the labour market spot the polarization effect. Very few, highly qualified will innovate and design new extensions of the virtual reality, while the work of “masses” will happen within this virtually set framework. If it really happens, ethical regression, or said differently, the absence of post-conventional ethical reasoning at that top level of organizations might have deeply deleterious, dehumanizing effects on a large scale, for other employees as well as for clients and users of services.

To conclude : What should we do to make ethical regression less likely?

There is no magic answer. The challenge has to be taken earnestly by many players. Universities and business schools as well as professional bodies have to prepare and train their students and members in post-conventional reasoning not only through theory but through real life situations. The post-conventional attitude requires both courage and communication skills. For universities and professional bodies, this is not a secondary task.

Much could be done at corporate level, for instance, by encouraging workshops where real life dilemmas are discussed with a focus on post conventional answers and thier underpinnings. Possibly also regulators could be more curious about the content of corporate cultures, especially in regulated businesses such as finance.

Last but not least – tools such as The “Tool-Kit of Ethics Self-Assessment” which is launched at this very conference – should be widely promoted and used in all kind of trainings and corporate life (http://esa.sgh.waw.pl/eng/).

Even if ethical regression might be on our doorsteps, it is never too late for a wake-up call

Thanks for your kind attention